Some companies build chips.

Some build mining machines.

Some just build narratives.

But what if one of them did all three?

What if they…

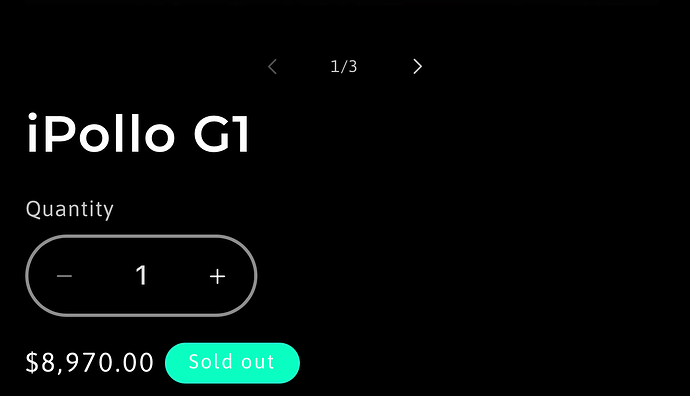

– Made the only machines for a forgotten coin

– Let others mine it till most of them gave up

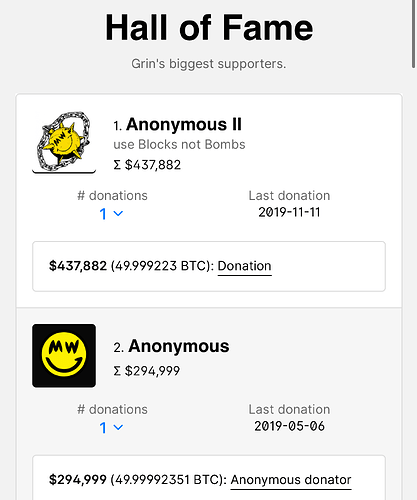

– Quietly hoarded supply

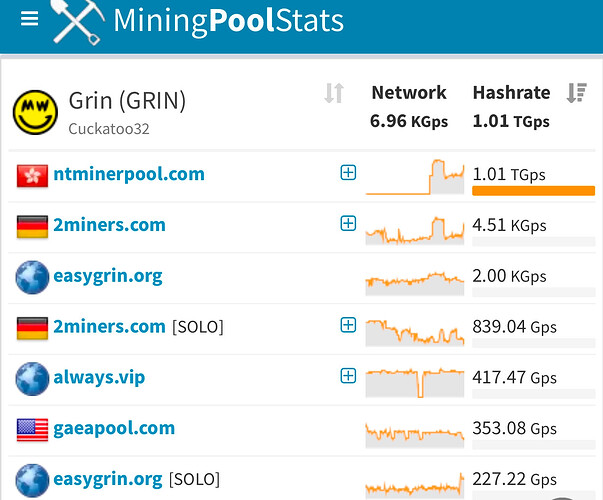

– Controlled hashrate

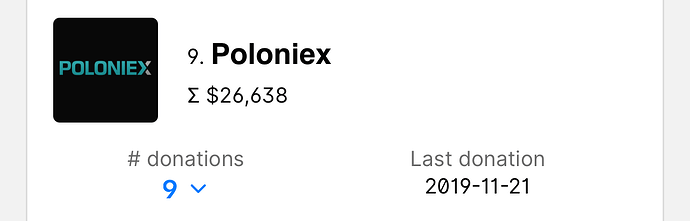

– Partnered on stablecoins

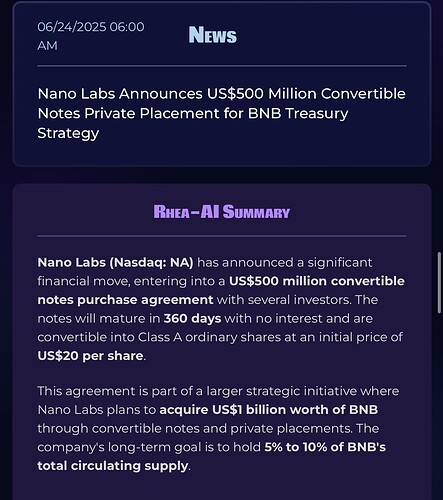

– Bought $50M in BNB

– Hinted at buying 10% of the BNB total supply

– And had their CEO sitting on a national AML tribunal?

What if that same CEO had already fought this exact script at Canaan Creative against Bitmain in the past?

What if that coin is now the most profitable one to mine…

…and nobody noticed? Even with a $10M market cap. Even with no hype. And even though its block reward will never shrink - 1 coin per second, forever.

Unlike others, it can’t die from starvation.

Machines are gone. Just single g minis available after few months of nothing.

And they?

Maybe they have the coins.

They have the hardware.

They own the mining monopoly.

What if you’re not looking at a stock,

but a switch?

Flip it - and you’ll understand.

It’s not a chip stock.

It’s a machine. A loop. A Trojan horse.

Nano Labs = MicroStrategy 2.0

Grin = Bitcoin 2.0

⸻

Ignore it.

Laugh at it.

Call it a conspiracy.

But when it moves…

don’t say the signs weren’t there.