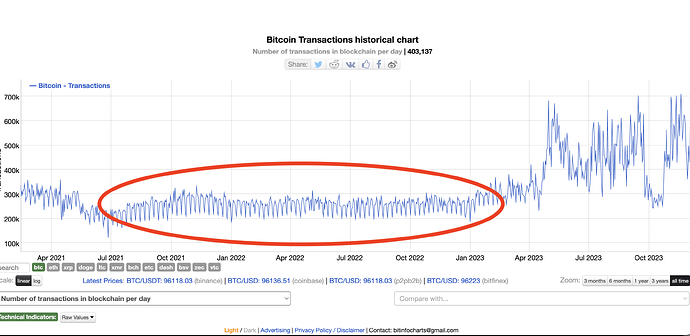

*automated or manipulated

Convid lockdown dead zone, but we still had active auto-payouts from pools.

interesting and likely correct observation which nicely explains the regular pattern: one spike per week during that 18 month period. so many payouts you think? it’s definitely possible

this would then represent some kind of baseline which could be subtracted from the final numbers of transactions per week to determine the real world usage of the bitcoin network outside of mining payments .

my exploration of these fundamental metrics in bitcoin has ben triggered by my new found interest in Grin and questions over the the success and adoption of the bitcoin payment network.

sufficed to say the numbers are alarming, with as little as 200k transactions per day many of which pertain to internal mining accounting in the form of payouts. or as mentioned in a previous post the P/S ratio (like a P/E ratio in traditional markets).

For example, on May1st the transaction fees on the bitcoin network totalled $331,199. At that rate it would take miners 15,942 years to match bitcoin’s $1,927,153,027,557 market capitalisation, thus giving Bitcoin a P/S ratio of 15942.

This is perhaps the highest P/S ratio bitcoin has ever had. On rare occasions traffic spikes and the P/S ratio falls to a much more reasonable number, but the network is of course totally overloaded:

For the first time since July 2019, the 7-day moving average of Bitcoin’s market cap to transaction fee ratio fell below that of Ethereum. Earlier this month, the moving average of Bitcoin’s ratio was 2,400 compared to just 118.33 for Ethereum, but on April 25, Bitcoin’s ratio had fallen down to 220.77, lower than Ethereum’s 227.12.

Thanks for your insights @Neo-Geo

My impression is that bitcoin isn’t really used since people are so incentized to diamond hodl, like with gold, which also isn’t really used, but rather set aside like a collectible. However, silver is a heavily used industrial metal in virtually all electronics, being the best conductor for electricity. So I prefer silver bullion over gold, which is why I also prefer Ethereum over Bitcoin, because ETH is actually being used, with heavy development for future improvement. Bitcoin, the slowest, most archaic, and often most expensive crypto chain to use. But maybe none of that matters when adoption has passed the point of no return (see businesses still using fax standards from 1968, smtp for email, IPv4 for internet). Yet bitcoin has been neutered into playing the role of digital gold, which leaves the position open for something else to be a peer to peer electronic cash system (not stablecoins, barf). Satoshi’s official forums recognized Grin’s value right away, making it the 1st and only worthy alternative payment that they accepted besides bitcoin. grin is now accepted for forum payments

By looking at the Bitcoiners I know, it appears Bitcoin is used as much by older Bitcoiners now as in the past.

The only difference, those activities used to be on layer 1 (on-chain), now they moved to layer 2 (lightning). The problem is that new Bitcoiners are mostly just investing, 90% only have BTC at an exchange, 10% have a self custodial wallet, 1% might setup their own Lightning node. Clearly the economic activity is insufficient to make economic activity pay for security on the long run. On the plus side, more and more places accept payment in Bitcoin now. Even some supermarkets. This means that there will be more stimulation to have a lightning wallet and use it. That is at least some success for Bitcoins as digital cash.

There is a speculation that Bitcoin became a speculative asset and then a currency.

When the price of this asset stabilizes (Bitcoin no longer grows), it can become a currency

A more stable price would indeed help Bitcoin be better digital cash🤔. For lightning opening and closing channel fees to sufficiently subsidies blocks its use does need to grow considerably though.

Time will tell.