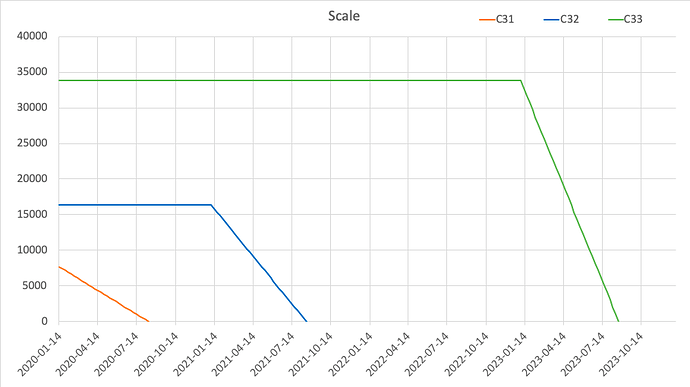

The graph size upgrades were introduced … as a means to resist single chip ASICs, which were deemed “not meaningfully different from pure computational ones like Bitcoin’s sha256".

…

All this was heavily put into doubt when Obelisk posted details of their GRN1 miner in … revealing simulation data of a single chip C31 ASIC as well as planned single chip ASICs for C32, C33, and C34.

Based upon the long discussion here, I didn’t see the obvious confirmation/s from other ASIC firms. So may I ask explicitly?

- Does everybody convince single chip ASIC for C32,C33,C34 are indeed feasible?

- The original graph size upgrading plan doesn’t help to avoid (or make it hard) to make single chip Grin ASIC?

If we maintain our commitment to the C32 phaseout, and have ASIC manufacturers make significant investments into C33 miners, then we lose the option of freezing the primary PoW at 32 edge bits. Which is a very natural size that’s easier to design circuits for. Also, there’s something nice about the memory requirement being a round 1GB.

If I understand well, we’re going to reverse direction: to make it easier for ASIC miner. Then, my question is why we don’t directly change the C31 phaseout plan? since the C31 make the ASIC even more easier.

And to protect the existing investment on C32 ASIC, we can keep both C31 and C32 but change the C31 phaseout plan to make it more fair between C31 and C32 ASIC miners.

According to current phaseout plan, the C31 miner has obviously shorter life time than C32 and it’s not fair for C31 miners. (mainly because the C31 miner come out a little bit late than expected!)

The Grin developers currently have no intention of changing these rules in the foreseeable future, unless Cuckatoo is shown to be broken (e.g. by exhibiting a sublinear time-memory tradeoff), or unless the phasing out of smaller sizes should be delayed in order to ensure public availability of >= 1 GPS miners.

^ According to our commitment on Cuckatoo31+ (im)mutability, even the Scheduled PoW upgrades proposal was added later than that commitment, I’m afraid we’re opening a back door to start breaking our commitments. I’m not against the necessary change/improvement, but just want to emphasize that we MUST be very careful and make the community well informed about this discussion, and please DON’T hurry to make decision unless we’re 100% sure.