The hardforks were preplanned before launch. People wiho have a problem with them cant read.

Without the hardforks, the code is not accepting any block from the hard-coded hardfork height, so a softfork can not progress the chain…

isn’t it possible to set conditions for a soft fork in which it will move along the chain?

I guess you could make your own coin and fork away from Grin. In all other cases if a coin changes the emission now, so far after the coin launch, then it will doom the project.

Let’s face it. GRIN was doomed the day it decided on infinite supply/emission.

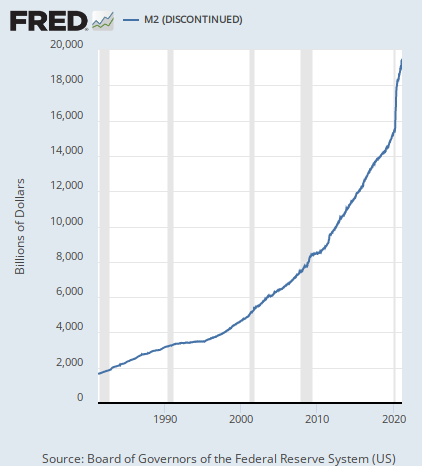

IF I wanted to own something with infinite emission, I would just hold onto my USD.

The Fed has done a great job of printing plenty of that and air dropping it into people’s bank accounts.

Yes it is infinite, but t is a linear emission. Do you get that? ![]()

Just my 2 Grin

Face it based on what? Because the price is not going up trying but finding a bottom? If you changed your opinion in Grin within the last 18 months that is something you should face yourself. As little to nothing changed about the fundamentals of this project. A fixed emission is a solid and genuine path to explore.

The issue is not unlimited supply, it is its predictability. Both Bitcoin and Grin solve this by having a very predictable supply model - Grin probably even more so because Bitcoin could be facing the ‘fee’ issue after a few more halvings. Though this is something that nobody knows how it will play out, it can go either way. On the other hand, you can’t predict USD printing.

The difference is that cryptocurrencies have a consistent printer that can’t be changed. Whether it halves the printing every 4 years or prints at a constant rate is completely irrelevant to the problem that the USD printer has.

Exactly, most don’t seem to understand this and think Grin is inflationary like USD. Which is so far from the truth. US monetary policy could change in a heartbeat based on the decision of a select few people( i.e the fed), it’s completely unpredictable. Grin’s monetary policy should never change. Not to mention that USD “inflation” is measured against a basket of goods( i.e CPI), not by how much the money supply has expanded- It’s a different definition of inflation vs the “inflation” term thrown around by Crypto folks

People who cant or dont understand linear emission are not the people that drive considerable price action. They are the FOMO people and buy/sell on news people that the whales feed on.

It’s limited emission though, not infinite. ![]()

.

.

.

(the following is a hypothetical conversation or debate)

“How is it limited? How is it not infinite?”

Simple, it’s limited to time, and time is not infinite. Let that sink in a little.

“Sure, time is not infinite and it has limitations, but relative to me, it might as well be unlimited.”

I can see your reasoning here, however emissions are still constrained to time in an unchanging way, and therefore bound to time and predictable. You will only live so long, so the emission rate is constant and predictable relative to your life-span (and everyone else’s). Once this is understood, then it’s easy to see how different it is from USD emissions

“Couldn’t the same be said for USD or any other currency that has emissions with no cap?”

No. Grin’s emission schedule is set in stone and does not change; it’s predictable. USD emissions is at the desecration of centralized actors, and its distribution is not based on mining market dynamics (rather the whims of these authoritarian actors). Choose for yourself: a monetary policy controlled by authority, or a monetary policy controlled by mathematics and code? You decide.

Grin’s supply is limited

PS: It’s arguable if The Fed has been doing a good job.

Sound like chicken egg problem to me. The reasoning is a bit circular and has been discussed a lot in regards to Bitcoin with the strongest arguments being made for the hash rate following the price of Bitcoin since it lags somewhat behind the value (miners are reactive not proactive in increasing their hash rate when the price goes up). For sure you are right there is a strong correlation between the security of a coin and its value but it would be wrong to argue the hash power (or graph power in case of Grin  ) is causal to the price. Note that if the emission rate is high like Grin in the first years, the price goes down. So the total amount earned by miners (and the hash/graph rate which is roughly proportional to the costs) is not necessarily higher with a higher emission rate.

) is causal to the price. Note that if the emission rate is high like Grin in the first years, the price goes down. So the total amount earned by miners (and the hash/graph rate which is roughly proportional to the costs) is not necessarily higher with a higher emission rate.

When I have time I might make a more thorough analysis comparing correlations between the price, market capitalization and hash/graph power of Bitcoin and Grin or maybe the top 100 coins, would make an interesting paper  .

.

18,386.1 Billions of Dollars

GRIN= 52 M

USD= 18,386,100 M

IDR= 6,567,700,000 M

1/353,578

1/126,301,923

Supply may be infinite, but there never will be infinitely many grin.

There will be at most 3 billion Grin emitted in your lifetime…

Some Yannis Varoufakis quotes:

"First, deflation is unavoidable in the bitcoin community because the maximum supply of bitcoins is fixed to 21 million bitcoins and approximately half of them have already been ‘minted’ at a time when very, very few goods and services transactions are denominated in bitcoins. To put simply, if bitcoin succeeds in penetrating the marketplace, an increasing quantity of new goods and services will be traded in bitcoin. By definition, the rate of increase in that quantity will outpace the rate of increase in the supply of bitcoins (a rate which, as explain, is severely constricted by the Nakamoto algorithm). In short, a restricted supply of bitcoins will be chasing after an increasing number of goods and services. Thus, the available quantity of bitcoins per each unit of goods and services will be falling causing deflation. And why is this a problem? For two reasons: First, because an expected fall in bitcoin prices motivates people with bitcoins to delay, as much as they can, their bitcoin expenditure (why buy something today if it will be cheaper tomorrow?). Secondly, because to the extent that bitcoins are used to buy factors of production that are used to produce goods and services, and assuming that there is some time lag between the purchase of these factors and the delivery of the final product to the bitcoin market, a steady fall in average prices will translate into a constantly shrinking price-cost margin for firms dealing in bitcoins.

Secondly, two major faultlines are developing, quite inevitably, within the bitcoin economy. The first faultline has already been mentioned. It is the one that divides the ‘bitcoin aristocracy’ from the ‘bitcoin poor’, i.e. from the latecomers who must buy into bitcoin at increasing dollar and euro prices. The second faultline separates the speculators from the users; i.e. those who see bitcoin as a means of exchange from those who see in it as a stock of value. The combination of these two faultlines, whose width and depth is increasing, is to inject a massive instability potential into the bitcoin universe. While it is true for all currencies that there is always some speculative demand for them, as opposed to transactions demand, in the case of bitcoin speculative demand outstrips transactions demand by a mile. And as long as this is so, volatility will remain huge and will deter those who might have wanted to enter the bitcoin economy as users (as opposed to speculators). Thus, just like bad money drives out good money (Gresham’s famous ‘law’), speculative demand for bitcoins drives our transactions demand for it."

(from https://www.yanisvaroufakis.eu/2013/04/22/bitcoin-and-the-dangerous-fantasy-of-apolitical-money/)

“Bitcoin is too deflationary by nature to act as a widespread currency alternative to the dollar or the euro”

Note that Yannis considers any predetermined emission to be economically flawed; he would simply find Grin’s emission to be slightly less flawed than Bitcoin’s.

That’s good stuff! It has never made sense to me that bitcoin could take over the world economy (even if you ignore that there is no decentralized blockchain tech that would even be capable of it.

The world economy is ~80 trillion and if you divide that by the total number of sats (2,100,000,000,000,000) you end up with one sat equal to $0.04. There is no way the smallest unit of currency can be 4 cents. This also assumes not a single sat has been lost. It just makes no sense.

Bitcoin faces many obstacles to taking over fiat, but size of the smallest unit does not appear to be one of them. Bitcoin could easily be extended to make a milli-satoshi the new smallest unit, and still have amounts fit comfortably within 64 bits.

A more recent article with solid criticism of bitcoin and cryptocurrencies in general:

More nice stuff. One way to address the effect of bitcoin supply/emission, like the value problem, liquidity problem, velocity problem is by the use of demurrage. Freicoin is trying this out